Energy: January pricing report

Energy bills are driven by both the price of energy on the wholesale market and Third-Party Costs (TPCs). TPCs include non-energy costs set by the government, network (the National Grid), policy and system costs and electricity transmission/distribution costs.

The biggest single cost on a bill is the price of the energy. Before the energy crisis the wholesale cost of energy made up approximately 40% of an electricity bill and 70% of a gas bill, with the remaining being TPCs, which have been continuously rising in recent years and can be volatile. Currently, with the rise in wholesale costs they are around 78% of a gas bill and 72% of an electricity bill.

This pricing report will focus on the energy element of a bill to help you keep track and understand the wholesale energy market and the factors affecting the price of your contracts.

OVERVIEW

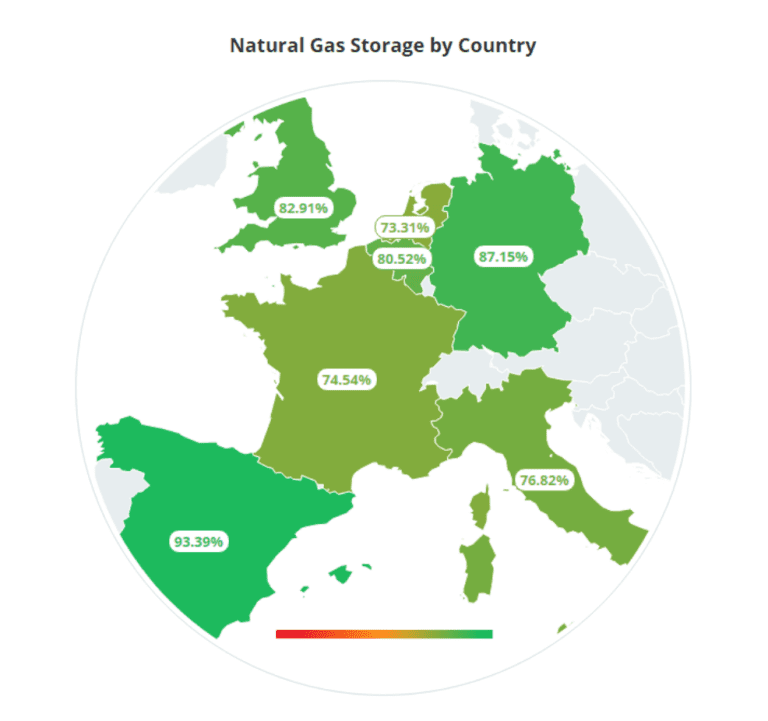

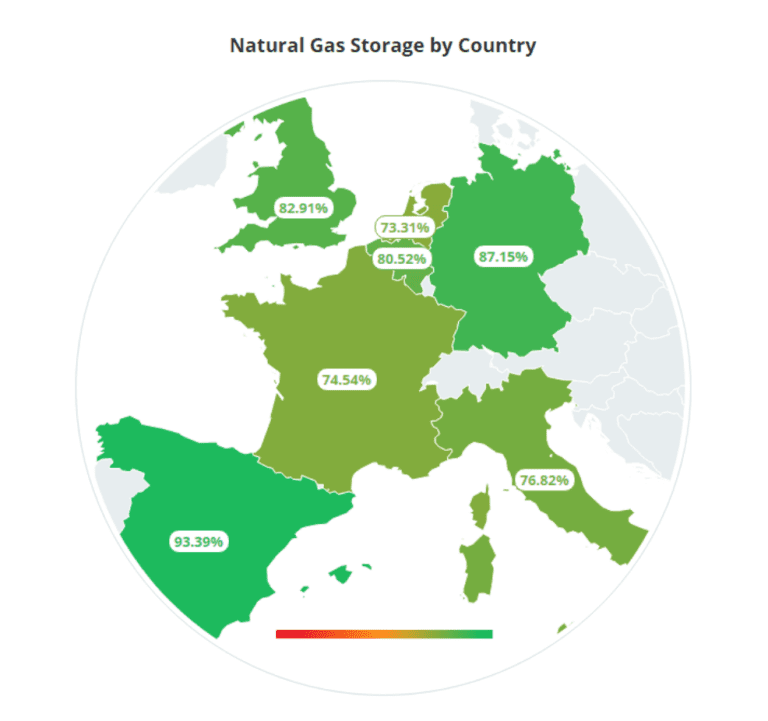

Gas prices have fallen this week, with temperatures higher than the seasonal norm, good wind speeds and strong levels of LNG cargoes. This has all supported European storage levels increasing to an all-time high for January and a reduction in gas for power demand. The fall in prices limits revenues to the Kremlin as Moscow is already squeezed by the G7 and EU price caps on oil.

Demand is expected to soften further in the next few days, with temperatures forecast to rebound following the recent cold snap. There are also expectations for more liquefied natural gas to enter the UK, as a key export terminal in the US takes steps to restart.

However, prices remain volatile and continued optimism that demand will increase with the end of lockdowns in China, meaning Europe will have to compete with Asia for LNG shipments.

Bullish Factors (upward pressure on markets):

- Demand in China predicted to rise

- Potential impacts of curbs on Russian exports

- Planned outages in Norway

Bearish Factors (downward pressure on markets):

- UK gas demand lower

- Strong storage levels

- Good wind speeds

- Temperatures below the seasonal average

- Steady number of LNG cargoes to the UK

gas and power

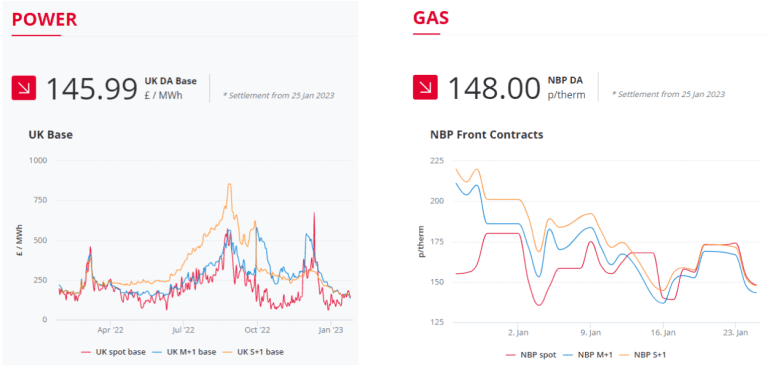

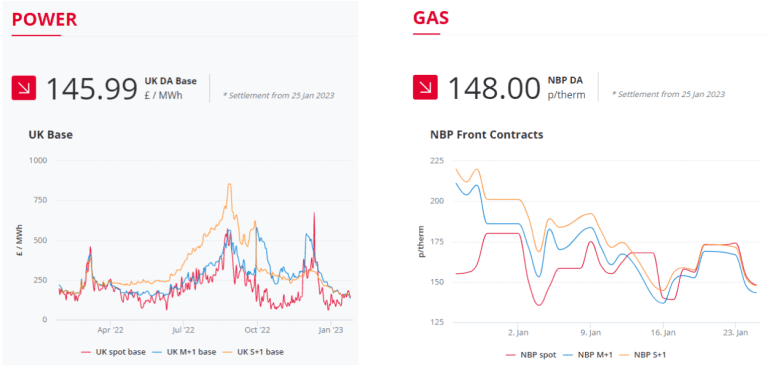

Gas and power prices have fallen this week with the milder temperatures, increased wind generation and good levels of storage in the UK and across Europe.

However, upcoming outages in Norway and the expectation that Europe will have to compete with Asia for LNG cargoes keeps prices subject to volatility.

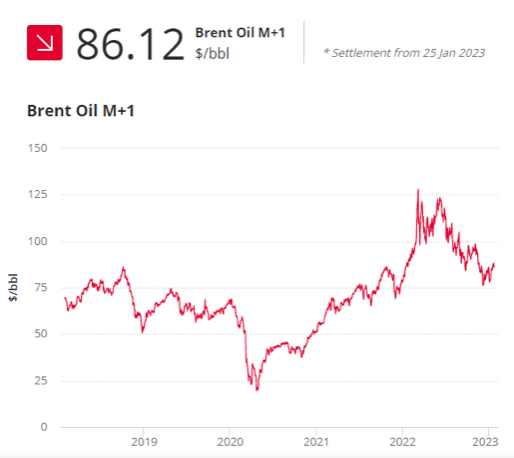

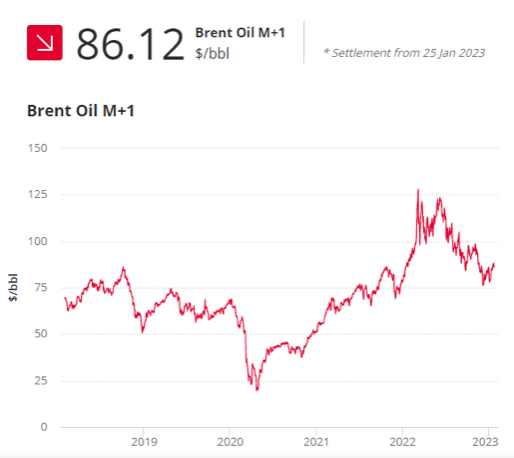

In the graphs, you can see that gas and power contracts starting now (spot), starting within the month head (M+1) and starting within the next season (S+1) all currently remain similar in price.

crude oil

Brent crude prices have increased slightly, mainly due to the continued optimism over increases in Asian demand now lockdowns in China have stopped.

Prices are 4.9% higher than at the start of 2023, but over 30% lower than when prices peaked in March 2022.

Current price standings:

Brent Crude = $82.12/bbl

European Gas Storage at Record High

A season in the business energy market is a 6-month spread and these are from April to September for “Summer” and October to March for “Winter”.

European gas storage has hit an all-time high for this time of year following on from a record-warm October last year. This helps to boost the energy security for Europe, especially Germany which is particularly vulnerable to the Russian gas supply cuts.

Strong LNG shipments and healthy gas stockpiles which are well above normal thanks to reduced consumption and a relatively mild winter — have significantly eased fuel prices over the past few weeks.

Brent Oil

EU gas storage is at 81% full, with German gas levels almost full at 90%, which is the highest level ever seen in January. With storage at these levels, Europe’s energy outlook is in a much stronger position now and most economies are likely to escape recession.

However the uncertainty and volatility around energy price remain. With demand in China picking back up gas prices could surge or supply disrupted as Europe competes with Asia for LNG supply. Any critical infrastructure is still at risk of any attempts at sabotage and Europe’s limited storage capacity means the energy prices for next winter are also subject to weather-related risks.